Cash positioning can help mitigate the potential for overdraft fees, unnecessary borrowing or extra wires.

To start, here are some things to consider: That means every business-regardless of its size-has the ability to conduct daily cash positioning. What does the process entail? Many businesses use Excel for cash positioning, even billion-dollar companies.

It provides a snapshot of liquidity that’s easy to digest and access, helping business leaders make informed decisions that get the most out of their funds.It helps to ensure the business has visibility across organizational cash levels and the funds to meet obligations.Why is it important? The value of cash positioning can be expressed on two levels: That may be an Excel spreadsheet or treasury management technology that includes tools for cash flow planning.

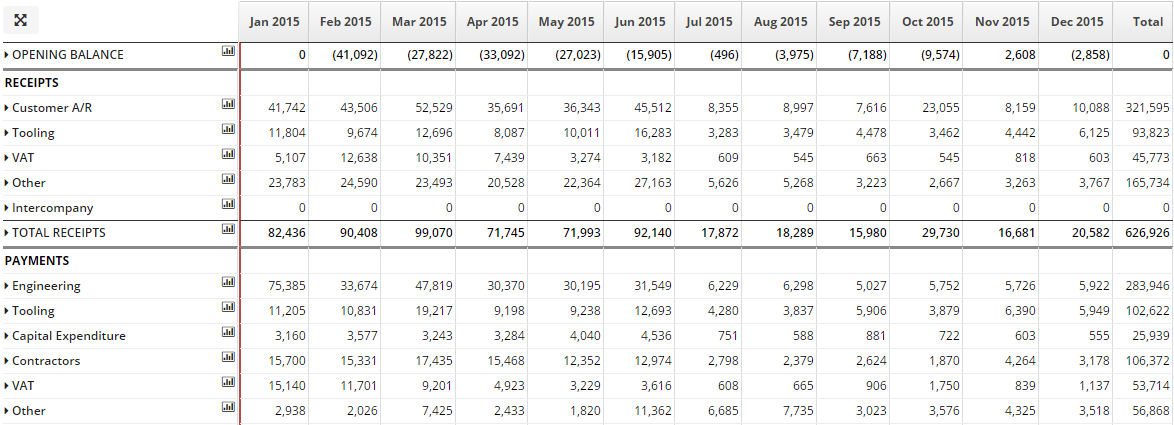

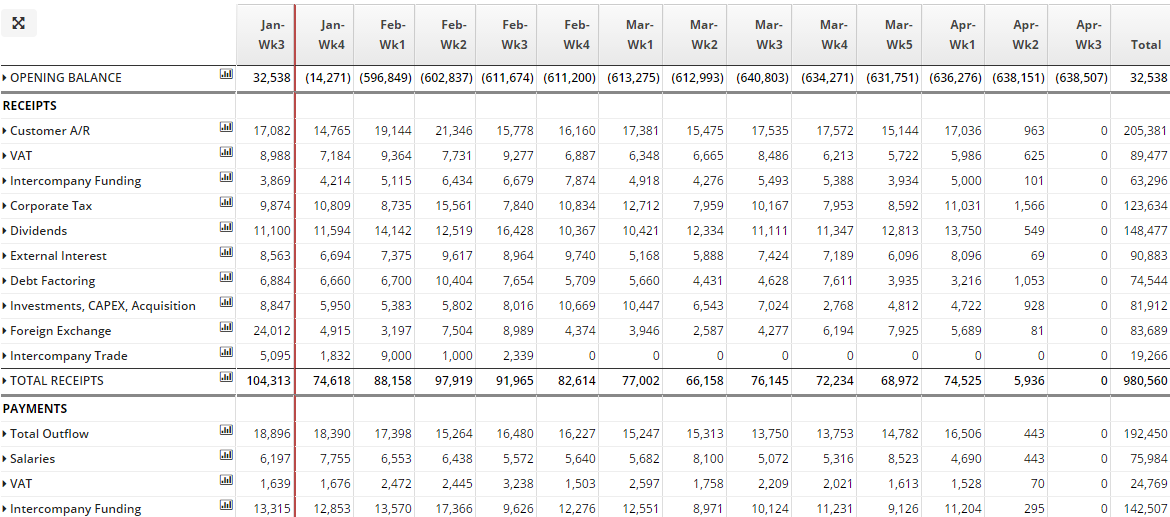

These processes-which are distinct but closely related-are essential to daily financial operations and decision-making for companies of all sizes and structural complexities.Īt a high level, cash positioning and forecasting can help businesses maximize investments, minimize expenses, map out expansion plans and much more.Ĭash positioning is the practice of aggregating daily account balance and transaction information in a single place to ensure there are enough funds to cover daily operating needs. To gain insights into liquidity, treasury needs a well-defined approach to cash positioning and cash forecasting.

#Treasury cashflow forecasting how to

Even as treasury teams evolve to take on more strategic roles, their core responsibility remains the same: to know how much money a business has, where it’s held and how to maximize use of funds so the business gets the most out of its money.

0 kommentar(er)

0 kommentar(er)